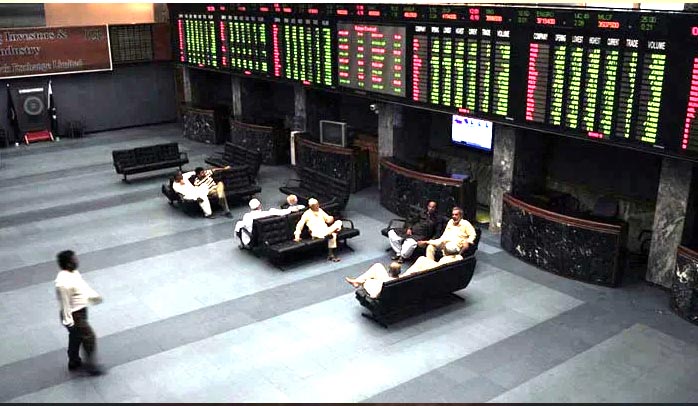

KARACHI: The Pakistan Stock Exchange (PSX) witnessed tepid trading in the outgoing week as Moody’s rating kept market participants mostly on the sidelines.

Moody’s decision, fluctuating rupee-dollar parity, and dwindling foreign exchange reserves played on investors’ minds during the week. Resultantly, the KSE-100 index declined 137 points or 0.3% to end the week at 41,948.50 points.

The market commenced the week on a positive note as investors’ interest revived on optimism that the State Bank of Pakistan (SBP) would maintain a status quo in its monetary policy announcement.

Investors’ interest was also fuelled by a statement from Finance Minister Ishaq Dar that Pakistan would not seek debt restructuring from the Paris Club and would meet all multi-lateral and international payment obligations.

The stock market, however, reversed the trend on Tuesday as investors opted for profit-booking owing to political and economic uncertainty.

The market extended losses as selling pressure continued to dominate as investors remained concerned over Moody’s downgrading five of Pakistan’s major banks. Investors took a cautious stance and resorted to value buying which led to some recovery during Wednesday’s session.

The bourse bounced back on Thursday and cushioned the dip amid renewed interest in selected stocks of the technology sector.

The index reversed its direction once again on the last trading session as a lack of positive triggers kept market players away from healthy participation, providing bears with an opportunity to dominate most of the trading session.

Other major developments during the week were: PSO wins arbitration case against Gunvor over LNG payments, Securities and Exchange Commission of Pakistan (SECP) registered 2,434 new firms in September, gas condensate discovered in Sanghar, inflation rate at 19.9%, IMF projected 3.5% growth for 2023.

Meanwhile, foreign buying continued this week, clocking in at $12.3 million against a net buy of $4.7 million recorded last week. Buying was witnessed in technology ($12.4 million), power (0.8 million), and cement ($0.3 million).-Agencies